Coffee: Production Rising Sharply, but Tariff Concerns Fuel Speculation

- Nicola Abis

- Mar 16

- 2 min read

Updated: Sep 15

Despite the sharp increase in coffee production in Colombia, prices remain close to historical highs due to speculation and uncertainties over possible U.S. tariffs. The Trump administration has threatened new tariffs on Colombian coffee imports, creating volatility in coffee futures.

Growing Production, but an Unstable Market

According to the National Federation of Coffee Growers of Colombia, production increased by 42% in February 2025, reaching 1.36 million 60-kg bags. Exports also grew by 14%, with 1.18 million bags shipped. This increase in supply should theoretically lower prices, but uncertainty over U.S. trade policies is holding back the market.

At the same time, the global market is facing a production surplus. According to a report by Marex Solutions, the global coffee surplus for the 2025/26 season could reach 1.2 million bags, compared to 200,000 bags in the previous season. This figure could exert downward pressure on prices in the medium term.

Coffee Futures in Strong Fluctuation

The prices of Arabica and Robusta coffee futures recorded significant movements in March 2025:

The decline in futures has been influenced by favorable weather conditions in Brazil, where rainfall in major Arabica-producing regions has alleviated drought concerns. Additionally, Vietnam’s exports increased by 6.6% in February 2025, boosting global supply and contributing to downward pressure on Robusta prices.

The technical outlook deserves special attention, especially when analyzing the monthly chart:

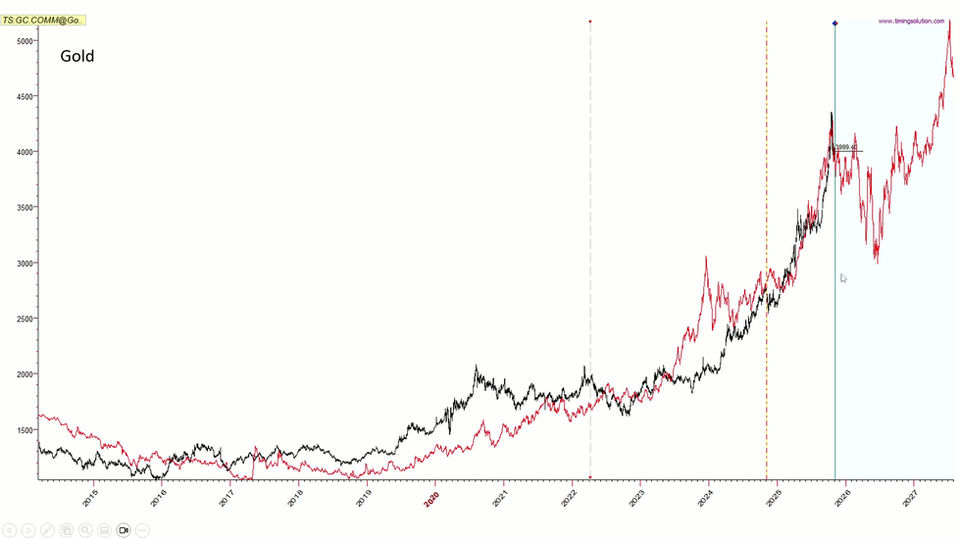

The loss of support at $366 could trigger a sharp correction towards $315. This scenario is not surprising: since autumn 2024, we have been monitoring the situation in our monthly video analyses for members. Below, in blue, is the forecast presented in our service months ago:

The blue curve is not an oscillator/moving average but a forecast curve generated using my Gann-based cyclical technique applied to statistical models, projected into the future before price movements occurred. This cycle allowed us to perfectly predict the market peak. The forecast for the entire 2025 period is available to our subscribers.

U.S. Tariffs and Speculation Keep Prices High

The National Coffee Association (NCA) of the United States has urged the Trump administration to exclude coffee from the new tariffs. According to FAO, increases in raw coffee prices impact demand with about a one-year delay, with effects lasting up to four years. As a result, even if futures prices were to drop in the coming months, the risk of a demand collapse in the following years may already be set in motion.

DISCLAIMER: The materials provided on this website are for informational and educational purposes only and should not be construed as investment advice, financial guidance, or any form of recommendation. The information contained on this website does not constitute a solicitation, offer, or recommendation to buy or sell any security, financial instrument, or asset to any person or entity in any jurisdiction. Users are solely responsible for their investment decisions. Trading and investing in financial markets involve substantial risk, including the potential loss of your entire investment.