Gold Inflation Adjusted: New All-Time High After 45 Years

- Nicola Abis

- Sep 15

- 3 min read

Updated: Sep 18

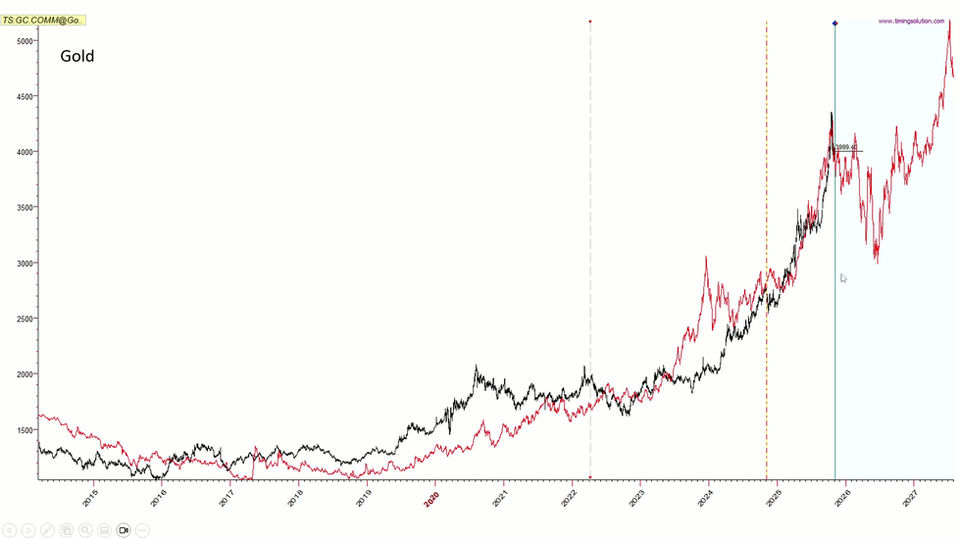

45 years later, gold has achieved the feat: the first week of September marked the end of a wait that lasted almost half a century. The inflation-adjusted Gold price has shattered the 1980 record - the one that for generations of investors represented the Everest of gold markets - stringing together six consecutive all-time highs in a single week. A conquest that goes beyond the dollar: gold has rewritten history in euros, pounds, yuan, and in every major currency on the planet.

Gold Price Inflation Adjusted

Tariffs, Rate Cuts and Gold: Prices at $5,000?

The US economy shows worrying signs of weakness. The Department of Labor has revised employment estimates downward by 911,000 units, the most significant correction in twenty years. For the first time since 2021, the number of unemployed exceeds that of available job openings. JPMorgan describes a scenario of "economic weakening", while Moody's warns about the risk of stagflation.

Within this framework, Ray Dalio openly recommends a gold component of 10-15% in portfolios, comparing US debt to an atherosclerotic plaque that threatens a financial "heart attack."

Goldman Sachs analysts focus on Fed rate cuts. Historically, contracting bond yields have often translated into further advances in precious metals: when bonds offer less, investors tend to orient toward safe-haven assets like gold to protect themselves from economic turbulence.

According to Goldman Sachs, if just 1% of the $27 trillion in US Treasuries flowed toward gold, the price could rocket to $5,000 per ounce. However, we cannot say whether Gold futures have already discounted future rate cuts or if the phenomenon could lead to similar advances.

Record After Record: Gold Conquers All Currencies

Central banks continue massive bullion purchases, while gold ETFs have attracted nearly $50 billion in 2025 - the second-best historical result according to the World Gold Council. Silver also shines with a +40% annual gain, touching fourteen-year highs, with projections hypothesizing a possible jump to $100 per ounce.

Gold Miners: Stellar Profits

With gold above $3,600 and extraction costs around $1,100 per ounce, every gram extracted generates extraordinary margins.

The contrast with the 2022-2023 period is incredible: when gold oscillated around $1,800, the mining sector was going through a profitability crisis. Average production costs (AISC - All-in Sustaining Costs) between 2022 and 2023 reached the historical record of $1,342 per ounce.

The perfect storm that hit the sector between 2022 and 2023 combined several factors: soaring energy prices, inflation on consumables, rising fuel and electricity costs, and a shortage in demand. Giants like Newmont and Barrick had to revise their cost forecasts upward. Many extraction sites were forced to reduce production or temporarily close.

Today mines are literally "extracting money," with revenues exceeding production costs by 3 times. The NYSE Arca Gold

Gold Cycles and Gold Stocks

Is all that glitters gold? For years I had exposed myself by talking about my gold investments maintained from the post-pandemic period until this 2025. However, on gold investment strategies it's necessary to contextualize the time horizon very well.

A Wall Street saying goes "Don't wait to buy gold. Buy gold and wait." This is certainly a good strategy in the long term, if we compare the performance between SP500 and gold from 2000 to today, Gold's performance shows a +1200% against a +360% of SP500. But we cannot forget the long bear markets of which gold has historically been a protagonist, and the only certainty is that any euphoria sooner or later ends.

If on a long-term horizon I totally agree with Ray Dalio's advice on stable holding of gold and silver among one's investments in a percentage of 10%, the medium term deserves much caution. And attention should be placed precisely on the 45-year cycle, a cycle so important that W.D. Gann himself titled his book "45 Years on Wall Street" after it.

And Gold Stocks? Here too, our seasonality dashboard invites us to exercise much CAUTION

We will delve deeper into the discussion with all subscribers in the coming days.

Anyone who wants to join us, quarterly subscriptions are now available to ride the last stretch of this crazy 2025! Contact us in chat for all information.

The materials provided on this website are exclusively for informational, educational and learning purposes and should never be interpreted as investment advice, financial consultation or any form of recommendation. The information contained in this site does not constitute a solicitation, offer or recommendation for the purchase or sale of financial products, financial instruments, securities or assets in any jurisdiction, neither for individuals nor for entities. Users are solely responsible for their own investment decisions.