Dollar Index Crash: Our Cyclical Analysis

- Nicola Abis

- Apr 3

- 3 min read

The Weight of Trump's Tariffs and Our Cyclical Analysis

April 3, 2025 – The Dollar Index is experiencing a sharp decline, dropping nearly 3% in just two sessions. This downturn has been triggered by the announcement of new tariffs imposed by President Donald Trump.

Since late 2024, our quantitative cyclical analysis system had already indicated a high probability of dollar weakness. While absolute certainties never exist, our strategy is based on interpreting statistical probabilities and the economic cycles active in a given market phase. In this case, it led us to take a short position on the dollar.

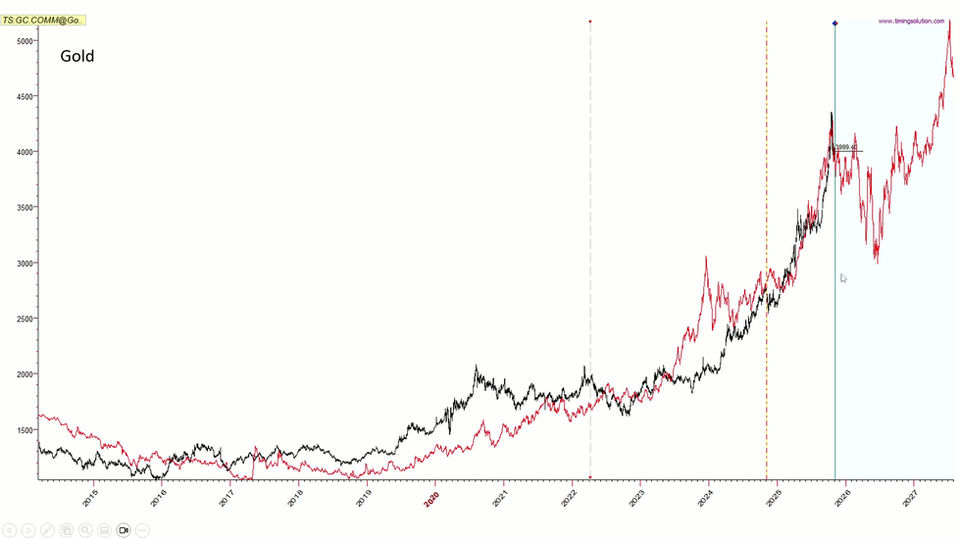

In the image, the Dollar Index is shown overlaid with the forecast cycle (in yellow) presented to our subscribers back in 2024. This yellow projection curve was calculated in August 2024 using our statistical models, and you can see how the price movements closely followed the projection with an impressive level of correlation!

Once again, operating based on probabilities has allowed us to be positioned on the right side of the market. While the market is always uncertain and subject to surprises, a data-driven and probability-based view can often lead to advantageous decisions.

The Mistake of Many Analysts

Many analysts in recent months had been forecasting a stronger dollar due to tariffs and the Fed’s slow pace in cutting interest rates, even theorizing that EURUSD could fall below parity. These analysts were misled by the neoclassical economic theory, which assumes that the imposition of tariffs should strengthen the domestic currency in the short term.

Here's how the neoclassical reasoning goes:

Tariffs reduce imports

Fewer imports = fewer dollars flowing out of the country

Reduced demand for foreign currencies by Americans

Resulting in relatively higher demand for dollars, which should strengthen the currency

However, as we know, economics is not an exact science, and the reality of an open market economy is far more complex than textbook theories. In the modern economic landscape, this mechanism must also account for many other factors, including:

Investors’ expectations about the negative impact of tariffs on economic growth

Monetary policies adopted in response to trade tensions

Trade retaliations from other countries

What to Expect Now?

The current cycle remains downward-oriented, and for now, there are no signs of a possible trend reversal. The high volatility in the markets clearly demands close monitoring of the situation, ready to promptly detect any potential signals of change.

The focus should now be on the upcoming support levels distributed between the 100.8 and 99.6 area.

Il ciclo attuale rimane orientato a ribasso e per ora non ci sono segnali di possibili inversioni di tendenza. L'elevata volatilità dei mercati impone chiaramente un attento monitoraggio della situazione, pronti a captare tempestivamente eventuali segnali di mutamento.

L'attenzione va ora posta sui prossimi livelli di supporto distribuiti tra l'area 100,8 e 99,6.

We will continue to monitor the situation week by week through our exclusive analyses for subscribers.

Disclaimer:

The materials provided on this website are intended solely for informational, educational, and learning purposes and should never be interpreted as investment advice, financial consultation, or any form of recommendation. The information contained on this site does not constitute a solicitation, offer, or recommendation to buy or sell financial products, instruments, securities, or assets in any jurisdiction, whether to individuals or entities. Users are solely responsible for their own investment decisions. Trading and investing in financial markets involve significant risks, including the potential loss of the entire capital invested.