Science considers seasonality one of the best investment strategies

- Nicola Abis

- Mar 10

- 3 min read

Updated: Sep 15

In the world of investments, there is a fundamental question that has spanned decades of academic debate and financial practice: are there systematic methods to achieve returns that outperform the market?

Recently, one of the most in-depth and authoritative studies ever conducted on this topic has provided a surprising answer: yes, these methods exist, and the best of them might be the least known—seasonality.

A groundbreaking study by Guido Baltussen, Laurens Swinkels, and Pim van Vliet, published under the title "Global Factor Premiums", analyzed 68 different markets over an extraordinary historical period—up to 217 years. Such an extensive time frame, almost unprecedented in academic research, allows for the evaluation of investment strategies with an exceptionally high degree of scientific certainty and robustness.

But let's take a step back: what are "global factor premiums"?

What Are Investment Factors?

Investment factors are strategies based on specific characteristics of financial assets that generate excess returns compared to the market. In simple terms, they are rules that allow investors to select potentially more profitable investments by relying on precise and repeatable patterns over time. The study in question tested the six most important global factors over an extremely long period—up to 217 years—and across 68 different markets, including stocks, bonds, currencies, and commodities.

Surprisingly, among all these factors, the one that proved to be the most powerful and robust over time was the least known to the general public: seasonality.

In investing, seasonality refers to recurring cyclical patterns of returns that occur at specific times of the year or month. Well-known examples of seasonality include the so-called "January effect" or the "Santa Claus rally" in stock markets.

What does the study say about seasonality?

The detailed analysis conducted by Baltussen and colleagues has shown that the seasonality-based strategy not only exists but is actually one of the most robust and reliable investment strategies over the long term, outperforming many other, more well-known strategies.

This result is extraordinary for at least three reasons:

Historical Validity: The study analyzed nearly two centuries of financial history, demonstrating that seasonality is not a recent or temporary phenomenon but rather a deeply rooted characteristic of the markets.

Global Validity: Seasonality was tested across 68 markets, including stocks, currencies, bonds, and commodities, showing remarkable consistency.

Limited Adoption Among Investors: Despite its effectiveness, the seasonality-based strategy remains underrated and underutilized by investors, who tend to focus on more traditional methods like Value Investing.

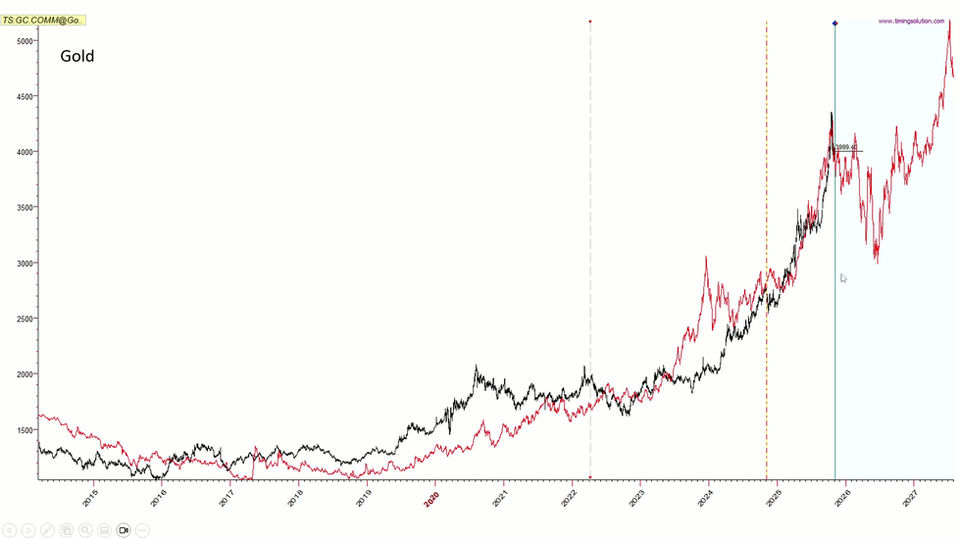

Our Seasonality Forecast vs Nasdaq, 2025

Why Does Seasonality Work So Well?

According to the authors, seasonality works so well due to investor behavior. For example, investors tend to repeat certain actions throughout the year—such as buying or selling stocks during specific periods for tax or accounting reasons—creating seasonal patterns that become investment opportunities.

Implications for Investors

This scientific research has significant implications for both private and professional investors:

Portfolio Diversification: By incorporating seasonality into their strategy, investors can significantly improve returns and reduce risks, especially during periods of market uncertainty.

Reliability: Investing based on seasonality allows investors to rely on well-established patterns over time, rather than chasing market trends or strategies based on recent but less reliable performance in the long run.

Conclusion

In summary, the study conducted by researchers at Erasmus University Rotterdam demonstrates that certain factors, particularly seasonality, are not temporary anomalies but rather deep and persistent characteristics of financial markets. The seasonal strategy proves to be a powerful resource, not only capable of generating high returns but also solid and resilient to long-term economic changes.

Investors, financial advisors, and fund managers would do well to seriously consider seasonality when constructing their portfolios, leveraging these valuable opportunities that the market offers—opportunities that scientific research has clearly shown to be among the most effective strategies ever.

Learn this Scientific Method

Through our training courses, you can learn this scientifically validated method and gain access to the world's most advanced statistical tools for analyzing markets using cyclicality. In a world where the vast majority of active funds underperform the S&P 500, our automatic scanner—selecting the top-performing seasonal stocks each month—outperformed the S&P 500 almost every month in 2024. A coincidence? Join us and start taking advantage of this technique today.